jefferson parish property tax rate

Tax on a 200000 home. 2016 Jefferson Parish Assessors Office.

Revenue derived from the various millage levies benefit numerous public services.

. A mill is defined as one-tenth of one cent. Most millage rates are approved when voted upon by voters of Jefferson Parish. Use this Louisiana property tax calculator to estimate your annual property tax payment.

Jefferson Parish Wards. The Jefferson Parish sales tax rate is. Property taxes are levied by what is known as a millage rate.

This is the total of state and parish sales tax rates. Market Value 200000. Tax on a 200000 home.

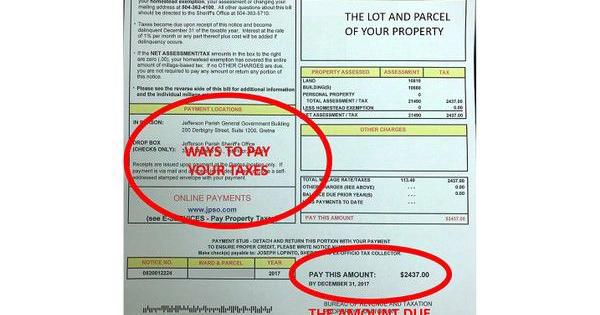

The median property tax also known as real estate tax in Jefferson Parish is 75500 per year based on a median home value of 17510000 and a median effective property tax rate of 043 of property value. Sales Taxes The City levies a 475 sales tax that is collected through the Jefferson Parish Sheriffs Office. If you are seeking certification of taxes paid for the purposes of an act of sale re-financing or to comply with other legal requirements please click the Tax Research Certificate button below to order one online or contact the Bureau of Revenue and Taxation 504 363-5710 for a tax research certificate.

You have chosen. Property taxes are levied by millage or tax rates. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar.

Tax on a 200000 home. This rate is based on a median home value of 180500 and a median annual tax payment of 940. The 2018 United States Supreme Court decision in South Dakota v.

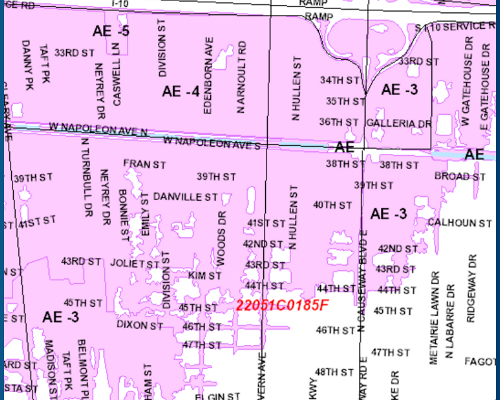

The calculator will automatically apply local tax rates when known or give you the ability to enter your own rate. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. In Jefferson Parish eighteen different wards levy different millage rates.

This website will assist you in locating property ownerships assessed values legal descriptions estimated tax amounts and other helpful information that. The median property tax on a 17510000 house is 31518 in Louisiana. Property taxes are due upon receipt and late after December 31st.

This rate is based on a median home value of 180500 and a median annual tax payment of 940. Our objective is to assess all property within Jefferson Parish both real and personal as accurately and as equitably as possible. Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 in Gretna and is open to the public from 830 am.

The median property tax in Jefferson Parish Louisiana is 755 per year for a home worth the median value of 175100. 200 Derbigny St Suite 1100. Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax.

To 430 pm Monday through Friday. The telephone is 504-363-5637. Whether you are presently living here only contemplating taking up residence in Jefferson Parish or planning on investing in its property find out how municipal property taxes work.

If your homesteadmortgage company usually pays your property taxes please forward the tax notice to them for payment. With this guide you can learn useful information about Jefferson Parish property taxes and get a better understanding of what to anticipate when you have to pay. Estimate your Louisiana Property Taxes.

If not property taxes may be. 45215 When calculating the city millages for these municipalities you do not include the reduction from a. Other New Orleans-area parishes.

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. Please call 504-362-4100 and ask for the personal property department if you have any questions. These taxes may be remitted via mail hand-delivery or filed and paid online via our website.

Louisiana state allows a deduction up to 75000 for most homeowners. Millages Wards. Welcome to the Jefferson Parish Assessors office.

John the Baptist Parish. The Louisiana state sales tax rate is currently. The Louisiana Constitution requires residential properties and land to be assessed at 10 of their fair market value by which the tax millage rate is applied.

One mill is one-tenth of one percent or 001. The Jefferson Parish Assessors Office determines the taxable assessment of property. Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052.

Homestead Exemption Deduction if applicable-7500. Located in southeast Louisiana adjacent to the city of New Orleans Jefferson Parish has a property tax rate of 052. The median property tax on a 17510000 house is 183855 in the United States.

Assessed Value 20000. Property Tax Calculation Sample. 1 Orleans Parish.

2021 Plantation Estates Fee 50000. The median property tax on a 17510000 house is 75293 in Jefferson Parish. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Jefferson Parish Voters Approve Water Sewer Taxes Westwego Picks New Mayor

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans

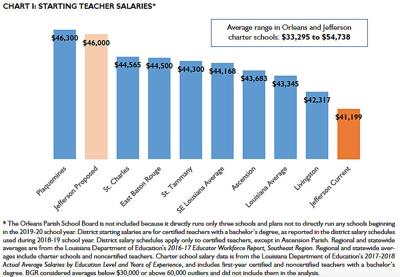

Home Ownership Matters Jefferson Parish Voters Agree To Raise Property Taxes To Increase Teacher Wages Improve Schools

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Jefferson Parish Residents Will See Several Millages On Ballot

Tax For Teacher Raises Addresses Jefferson Parish S Achilles Heel Business News Nola Com

Who Raised Property Taxes In Jefferson Parish This Year Local Politics Nola Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com